Published by – Goutam Kumar Jena

on behalf of GNEXT MS OFFICE

Category - Government & Subcategory - Tax Deduction

Summary - Sections & limit for Indian Tax payer employee under Indian Tax Act

Who can see this article:- All

Your last visit to this page was @ 2018-04-04 21:02:13

Create/ Participate in Quiz Test

See results

Show/ Hide Table of Content of This Article

| A |

Article Rating

|

Participate in Rating,

See Result

|

Achieved( Rate%:- NAN%, Grade:- -- ) |

| B | Quiz( Create, Edit, Delete ) |

Participate in Quiz,

See Result

|

Created/ Edited Time:- 14-12-2017 23:55:40 |

| C | Survey( Create, Edit, Delete) | Participate in Survey, See Result | Created Time:- |

| D |

| Page No | Photo | Page Name | Count of Characters | Date of Last Creation/Edit |

|---|---|---|---|---|

| 1 |  |

Tax Saving Deduction | 8847 | 2017-12-14 23:55:40 |

Rating for Article:– Tax Deduction Section for Indian Taxpayer Employee ( UID: 171206130624 )

Rating Module ( How to get good rate? See Tips )

If an article has achieved following standard than it is accepted as a good article to promote. Article Grade will be automatically promoted to A grade. (1) Count of characters: >= 2500

(2) Writing Originality Grand total score: >= 75%

(3) Grand Total score: >= 75%

(4) Count of raters: >= 5 (including all group member (mandatory) of specific group)

(5) Language of Article = English

(6) Posted/ Edited date of Article <= 15 Days

(7) Article Heading score: >=50%

(8) Article Information Score: >50%

If the article scored above rate than A grade and also if it belongs to any of the below category of article than it is specially to made Dotted underlined "A Grade". This Article Will be chosen for Web Award.

Category of Article: Finance & banking, Insurance, Technology, Appliance, Vehicle related, Gadgets, software, IT, Income, Earning, Trading, Sale & purchase, Affiliate, Marketing, Medicine, Pharmaceuticals, Hospital, Money, Fashion, Electronics & Electricals, Jobs & Job work, Real estate, Rent Related, Advertising, Travel, Matrimonial, Marriage, Doctor, Food & beverages, Dining, Furniture & assets, Jewellery, ornaments, Gold, Diamond, Silver, Computer, Men Wear, Women’s wear, Dress, style, movie, film, entertainment.

* Give score to this article. Writer has requested to give score/ rating to this article.( Select rating from below ).

* Please give rate to all queries & submit to see final grand total result.

| SN | Name Parameters For Grading | Achievement (Score) | Minimum Limit for A grade | Calculation of Mark |

|---|---|---|---|---|

| 1 | Count of Raters ( Auto Calculated ) | 0 | 5 | 0 |

| 2 | Total Count of Characters in whole Articlein all pages.( Auto Calculated ) | 8847 | 2500 | 1 |

| 3 | Count of Days from Article published date or, Last Edited date ( Auto Calculated ) | 2322 | 15 | 0 |

| 4 | Article informative score ( Calculated from Rating score Table ) | NAN% | 40% | 0 |

| 5 | Total % secured for Originality of Writings for this Article ( Calculated from Rating score Table ) | NAN% | 60% | 0 |

| 6 | Total Score of Article heading suitability to the details description in Pages. ( Calculated from Rating score Table ) | NAN% | 50% | 0 |

| 7 | Grand Total Score secured on over all article ( Calculated from Rating score Table ) | NAN% | 55% | 0 |

| Grand Total Score & Article Grade | --- |

| SI | Score Rated by Viewers | Rating given by (0) Users |

|---|---|---|

| (a) | Topic Information:- | NAN% |

| (b) | Writing Skill:- | NAN% |

| (c) | Grammer:- | NAN% |

| (d) | Vocabulary Strength:- | NAN% |

| (e) | Choice of Photo:- | NAN% |

| (f) | Choice of Topic Heading:- | NAN% |

| (g) | Keyword or summary:- | NAN% |

| (h) | Material copied - Originality:- | NAN% |

| Your Total Rating & % | NAN% |

Show/ Hide Rating Result

Details ( Page:- Tax Saving Deduction )

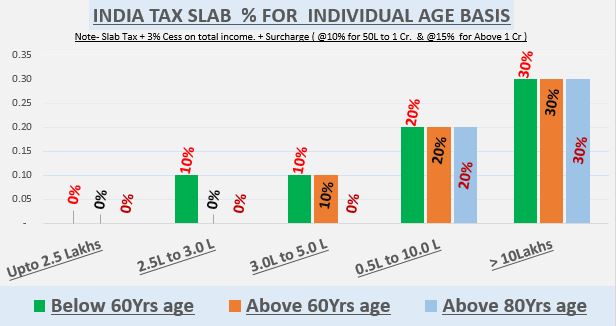

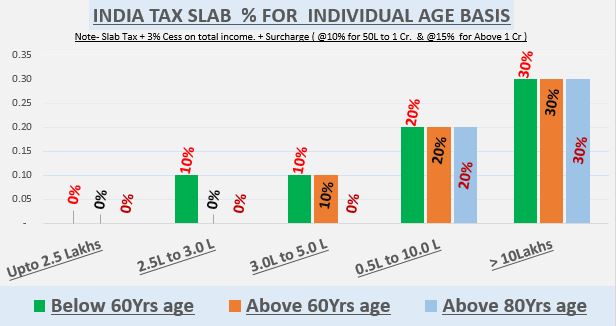

Tax Saving Deductions

Available for Indian Tax Payer Salaried Employee ( FY 2017 – 18 )

Every Individual Tax payer has legal right to use all methods to avoid tax by using legally available sections to reduce his taxable income.

See below listed sections available for deduction for reducing taxable income of a salaried employee. But , it is advised to take help of an expert for correct interpretations and analysis. Because All available options such as LTA or, exact applicability of each section etc. need to be understood correctly, which may be missing below.

Section 10

If you receive HRA as part of your salary and you live in a rented accommodation, then you can claim full or partial HRA exemption under section 10.

HRA deduction is allowed on the basis of below points , which ever is less.

1) Actual HRA received or, 2)Actual rent paid reduced by 10% of salary or, 3) 50% of basic salary, if, living in a metro city or, 4) 40% of basic salary ,if, living in a non-metro city.

______________________________________________________________________

Section 24 :- Deduction allowed for Payment of Interest on Home Loan

( A ) Self occupied :-

(i) Completed within 5 Yrs – Deduction Limit INR 2,00,000

(ii) Not Completed within 5 Yrs - Deduction Limit INR 30,000

( B ) Not Self occupied :- No Limit

______________________________________________________________________

Section 80

Section – 80 C ( for an Individual or an HUF )

Section 80C – Investment in any of the below listed purpose comes under 80C.

(1 ) Investment in PPF . (2) Employee’s share of PF contribution NSCs ( 3) Life Insurance Premium payment ( 4) Children’s Tuition Fee ( 5 ) Principal Repayment of home loan (after completion certificate awarded ) ( 6 ) Investment in Sukanya Samridhi Account ( 7) ULIPS ( 8 ) ELSS ( 9) Sum paid to purchase deferred annuity ( 10 )Five year deposit scheme ( 11 ) Senior Citizens savings scheme ( 12 ) Subscription to notified securities/notified deposits scheme ( 13 ) Contribution to notified Pension Fund set up by Mutual Fund or UTI. ( 14 ) Subscription to Home Loan Account Scheme of the National Housing Bank ( 15 ) Subscription to deposit scheme of a public sector or company engaged in providing housing finance ( 16 ) Contribution to notified annuity Plan of LIC ( 17 ) Subscription to equity shares/ debentures of an approved eligible issue ( 18 ) Subscription to notified bonds of NABARD

Section 80CCC –

Annuity plan of LIC or any other insurer for pension from a fund referred to in Section 10(23AAB).

Section 80CCD(1) - Contribution to Pension Account –

10% of Salary (Max Allowed ) or, Rs 1.5Lakhs which ever is less.

Under Above mentioned sections ( i.e. 80C, 80CCC, & 80CCD(1) ) -

A combined deduction limit of Rs. 1,50,000 can be claimed and Taxable total income can be reduced.

_________________________________________________________________

Section 80CCD (1B) - Additional deduction of up to Rs 50,000 for deposit to NPS Account is allowed. Contribution to Atal Pension Yojna is also eligible.

Section 80CCD (2) - Additional deduction is allowed for employer’s contribution to employee’s pension account of up to 10% of the salary of the employee.

________________________________________________________________

Section 80CCG - Rajiv Gandhi Equity Saving Scheme (RGESS).

Whichever is less from 50% of investment or, Rs 25000 for 3 years.

80CCG is discontinued starting from April 1, 2017. Therefore, no deduction under section 80CCG will be allowed from AY 2018-19. But, if you have invested in the RGESS scheme in FY 2016-17 (AY 2017-18), then you can claim deduction under Section 80CCG until AY 2019-20.

________________________________________________________

Section 80GG: Deduction for House Rent Paid, if HRA is not Received.

Minimum of any of below 3 criteria –

(1 ) Rent paid over 10% of total Salary (Basic + D.A.) ( 2) Rs 5000/- per month ( 3) 25% of total Salary ( before deduction ) .

___________________________________________________________

Section 80D - premium paid for Medical Insurance

( For self, Spouse, dependent children )

Rs 25,000 – if self & Spouse is below 60 Years of age & Rs 30,000 – if self & Spouse above 60 Years of age.

+ Additional deduction for Parents-

Rs 25,000 – if below 60 Years of age & Rs 30,000 – if above 60 Years of age.

+ Additional deduction - preventive health check-up-

Max Rs.5000 (From AY 2016-17)

______________________________________________________________

Section 80DD - Rehabilitation of Handicapped Relative.

(Certificate from a certified Specialist Required).

If, Disability is 40% or more , than– fixed deduction of Rs 75,000.

If, Disability is 80% or more , than– fixed deduction of Rs 1,25,000.

_______________________________________________________________

Section 80DDB - Deduction for Medical Expenditure on Self or Dependent Relative.

A deduction Rs. 40,000/-( 60,000 for senior citizen & Rs.80,000 for very Senior Citizen) or the amount actually paid, whichever is less. The diseases have been specified in Rule 11DD. A certificate in form 10 I is to be furnished by the taxpayer from any Registered Doctor.

_____________________________________________________________________

Section 80U - Deduction for Physical Disability (Rule 11D ) – With Certificate from a Govt. Doctor

In Case of , physical Disability (including blindness) or mental retardation – Rs 75,000

In Case of , Above but Severe Disability– Rs 1,25,000

_______________________________________________________________

Section 80E - Interest on Education Loan for Higher Studies –

The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier.

________________________________________________________________

Section 80EE – Home Loan Interest for ( First Time Home Owners )

Limit is Rs. 50,000 in addition to Sec. 24( please see above) .

- Not available for FY 2017-18 because, this is Applicable if, The loan sanctioned between 1st April 2016 and 31st March 2017.

Note that, Loan amount should be less than Rs. 35Lakhs & Property Value is less than Rs.50lakhs.

Deduction would be available till the time the repayment of the loan continues

________________________________________________________________

Section 80 TTA – Interest on Bank Savings

A Deduction of maximum Rs 10,000 from Gross Total Income for Interest on Savings Bank Account with a bank, co-operative society, or post office.

Section 80TTA deduction is not available on interest income from fixed deposits, recurring deposits, or interest income from corporate bonds.

__________________________________________________________________

Section 80RRB - Income by way of Royalty of a Patent

Rs. 3 lakhs or the income received, whichever is less

___________________________________________________________________

Section 80G: Donations towards Social Causes . This can be any of below as per specification/s.

In some cases - 100% or, 50 % deduction without any qualifying limit as per the case.

Also In some cases - 100% or, 50 % subject to 10% of adjusted gross total income of payer.

But , The donations above Rs 2000 should be made other than cash to qualify as deduction u/s 80G.

____________________________________________________________________

Section 80GGC - Contributions to Political Parties by any way other than cash

End of Page

Please select any one of the below options to give a LIKE, how do you know this unit.