Published by – Goutam Kumar Jena

on behalf of GNEXT MS OFFICE

Category - Finance & economics & Subcategory - Education

Summary - Basic rules of accounting & fundamentals of Debit and credit

Who can see this article:- All

Your last visit to this page was @ 2018-04-03 15:29:45

Create/ Participate in Quiz Test

See results

Show/ Hide Table of Content of This Article

| A |

Article Rating

|

Participate in Rating,

See Result

|

Achieved( Rate%:- NAN%, Grade:- -- ) |

| B | Quiz( Create, Edit, Delete ) |

Participate in Quiz,

See Result

|

Created/ Edited Time:- 23-10-2017 20:58:03 |

| C | Survey( Create, Edit, Delete) | Participate in Survey, See Result | Created Time:- |

| D |

| Page No | Photo | Page Name | Count of Characters | Date of Last Creation/Edit |

|---|---|---|---|---|

| 1 |  |

Debit & Credit | 19315 | 2017-10-23 20:58:03 |

Rating for Article:– Basic Accounting of Debit & Credit ( UID: 171021175551 )

Rating Module ( How to get good rate? See Tips )

If an article has achieved following standard than it is accepted as a good article to promote. Article Grade will be automatically promoted to A grade. (1) Count of characters: >= 2500

(2) Writing Originality Grand total score: >= 75%

(3) Grand Total score: >= 75%

(4) Count of raters: >= 5 (including all group member (mandatory) of specific group)

(5) Language of Article = English

(6) Posted/ Edited date of Article <= 15 Days

(7) Article Heading score: >=50%

(8) Article Information Score: >50%

If the article scored above rate than A grade and also if it belongs to any of the below category of article than it is specially to made Dotted underlined "A Grade". This Article Will be chosen for Web Award.

Category of Article: Finance & banking, Insurance, Technology, Appliance, Vehicle related, Gadgets, software, IT, Income, Earning, Trading, Sale & purchase, Affiliate, Marketing, Medicine, Pharmaceuticals, Hospital, Money, Fashion, Electronics & Electricals, Jobs & Job work, Real estate, Rent Related, Advertising, Travel, Matrimonial, Marriage, Doctor, Food & beverages, Dining, Furniture & assets, Jewellery, ornaments, Gold, Diamond, Silver, Computer, Men Wear, Women’s wear, Dress, style, movie, film, entertainment.

* Give score to this article. Writer has requested to give score/ rating to this article.( Select rating from below ).

* Please give rate to all queries & submit to see final grand total result.

| SN | Name Parameters For Grading | Achievement (Score) | Minimum Limit for A grade | Calculation of Mark |

|---|---|---|---|---|

| 1 | Count of Raters ( Auto Calculated ) | 0 | 5 | 0 |

| 2 | Total Count of Characters in whole Articlein all pages.( Auto Calculated ) | 19315 | 2500 | 1 |

| 3 | Count of Days from Article published date or, Last Edited date ( Auto Calculated ) | 2370 | 15 | 0 |

| 4 | Article informative score ( Calculated from Rating score Table ) | NAN% | 40% | 0 |

| 5 | Total % secured for Originality of Writings for this Article ( Calculated from Rating score Table ) | NAN% | 60% | 0 |

| 6 | Total Score of Article heading suitability to the details description in Pages. ( Calculated from Rating score Table ) | NAN% | 50% | 0 |

| 7 | Grand Total Score secured on over all article ( Calculated from Rating score Table ) | NAN% | 55% | 0 |

| Grand Total Score & Article Grade | --- |

| SI | Score Rated by Viewers | Rating given by (0) Users |

|---|---|---|

| (a) | Topic Information:- | NAN% |

| (b) | Writing Skill:- | NAN% |

| (c) | Grammer:- | NAN% |

| (d) | Vocabulary Strength:- | NAN% |

| (e) | Choice of Photo:- | NAN% |

| (f) | Choice of Topic Heading:- | NAN% |

| (g) | Keyword or summary:- | NAN% |

| (h) | Material copied - Originality:- | NAN% |

| Your Total Rating & % | NAN% |

Show/ Hide Rating Result

Details ( Page:- Debit & Credit )

Debits and Credits- Accounting Rules & Basics

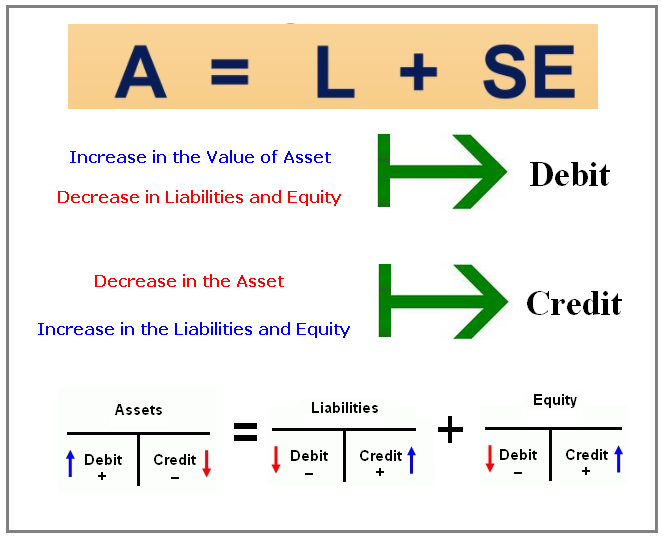

In keeping with the double-entry system of accounting, a minimum of two accounts is needed for every transaction. At least one account is debited and at least one account is credited. if, you have identified the two or more accounts involved in a business transaction, you must debit at least one account and credit at least one account.

To debit an account means to enter an amount on the left side of the account. To credit an account means to enter an amount on the right side of an account.

BASIC NOTE - Debit means left, Credit means right

Generally these types of accounts are increased with a debit:

Dividends (Draws), Expenses, Assets, Losses

Note- D - E - A - L Accounts are increased with a debit.

Generally the following types of accounts are increased with a credit:

Gains, Income, Revenues, Liabilities, Stockholders' (Owner's) Equity

Note - G - I - R - L - S Accounts are increased with a credit.

Note - To decrease an account you do the opposite of what was done to increase the account.

EXAMPLE

An asset account is increased with a debit. Therefore it is decreased with a credit.

The abbreviation for debit is Dr. and the abbreviation for credit is cr.

Some general rules about debiting and crediting the accounts are:

Expense accounts are debited and have debit balances

Revenue accounts are credited and have credit balances

Asset accounts normally have debit balances

To increase an asset account, debit the account

To decrease an asset account, credit the account

Liability accounts normally have credit balances

To increase a liability account, credit the account

To decrease a liability account, debit the account

What do you mean by debit and credit balance of an account?

Debits and credits balance each other . Means, if a debit is added to one account, then a credit must be added to the an opposite account.

In accounting, the debit column is on the left of an accounting entry, while credits are on the right. Debits increase asset or expense accounts and decrease liability or equity.

Why is an expense account debited?

Balances on the right side of an account are credit balances. Since expenses cause a decrease to the owner's equity credit balance, a debit entry is required. However, at the time that the expense is recorded, the amount is entered as a debit in anexpense account.

Can you credit an expense account?

Some instances when general ledger expense accounts are credited include: the end-of-year closing entries. the reversing entry for a previous accrual adjusting entry involving an expense. an adjusting entry to defer part of a prepayment that was debited to an expense account.

Why do revenues have a credit balance?

Liabilities and owner's equity are on the right side of the accounting equation and thebalances in the liability and owner's equity accounts are normally on the right side of the accounts. ...

A credit entry in a revenue account will cause the credit balance in an owner's equity capital account to increase.

Is service revenue a debit or credit?

At the time the service is performed the revenues are considered to have been earned and they are recorded in the revenue account Service Revenues with a credit. The other account involved, however, cannot be the asset Cash since cash was not received. The account to be debited is the asset account Accounts Receivable.

Which types of accounts normally have a credit balance?

Assets, expenses, losses, and the owner's drawing account will normally have debit balances. Their balances will increase with a debit entry, and will decrease with a credit entry. Liabilities, revenues and sales, gains, and owner equity and stockholders' equity accounts normally have credit balances.

Why profit is a credit?

The profit or net income belongs to the owner of a sole proprietorship or to the stockholders of a corporation. The owner's or stockholders' equity is reported on the credit side of the balance sheet. Recall that the balance sheet reflects the accounting equation, Assets = Liabilities + Owner's Equity.

Is an increase in inventory a debit or credit?

Since Assets, Draw, and Expense Accounts normally have a Debit Balance, in order to Increase the Balance of an Asset, Draw, or Expense Account enter the amount in the Debit or Left Side Column and in order to Decrease the Balance enter the amount in the Credit or Right Side Column.

Is Accounts Receivable a debit or credit?

The client is buying on account or paying later, which makes it an Accounts Receivable, which is an asset. When an asset increases, it is a Debit. A sale is considered Revenue or Income, which is shown as REVENUE on the chart. When revenue increases, it is a credit.

What is a revenue item?

Revenue is shown usually as the top item in an income (profit and loss) statement from which all charges, costs, and expenses are subtracted to arrive at net income. Also called sales, or, turnover.

What are the revenues in accounting?

Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery. Often the term income is used instead of revenues.

What does a general ledger of a company Contain?

The ledger provides a complete record of financial transactions over the life of thecompany. The ledger holds account information that is needed to prepare financialstatements and includes accounts for assets, liabilities, owners' equity, revenues and expenses.

What is debit balance of profit and loss account?

Under the 'double entry' accounting convention, income items in the Profit and loss account are Credits (CR) and expenses are Debits (DR). A net profit is a Credit in the Profit and loss account. A net loss is a Debit in the Profit and loss account.

When Cash Is Debited and Credited?

Because cash is involved in many transactions, it will be easy to understand as below:-

- Whenever cash is received, debit Cash,

- whenever cash is paid out, credit Cash.

Normal Debit or Credit Balances ?

See below debit or credit balance you would normally find in the account after Looking at T-account for each of the account classifications in the general ledger .

Account classification & Normal Balance are:-

Assets – Debit Balance , Contra Liability – Debit Balance

Owner’s Drawing or, Divident Accounts - Debit Balance

Expenses – Debit Balance

Losses – Debit Balance

Liability – Credit Balance, Contra Assets – Credit Balance

Owner’s Equity - Credit Balance

Stockholder’s Equity - Credit Balance

Income / Revenue - Credit Balance

Gains - Credit Balance

Revenues and Gains Are Usually Credited ?

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts have debit balances because they are reductions to sales. Accounts with balances that are the opposite of the normal balance are called contra accounts; hence contra revenue accounts will have debit balances.

Whenever cash is received, the asset account Cash is debited and another account will need to be credited. Since the service was performed at the same time as the cash was received, the revenue account Service Revenues is credited, thus increasing its account balance.

Expenses and Losses are Usually Debited ?

Expenses normally have their account balances on the debit side (left side).

A debit increases the balance in an expense account; a credit decreases the balance. Since expenses are usually increasing, think "debit" when expenses are incurred.

We credit expenses only to reduce them, adjust them, or to close the expense accounts.

Examples of expense accounts include Salaries Expense, Wages Expense, Rent Expense, Supplies Expense, and Interest Expense.

Bank's Debits and Credits ?

Bank credit means the transaction will increase your checking account balance.

If, your bank debits your account means your checking account balance decreases.

Although the above rule may seem contradictory & confusing because you have read that , debiting the Cash account in the general ledger increases its balance and crediting the Cash account in the general ledger reduces its balance.

But bank says it is debiting your account to reduce its balance and crediting your account to increase its balance.

But interestingly, bank's treatment of debits and credits is indeed consistent with the basic accounting principles. You have to see some example & background journal entry to understand further.

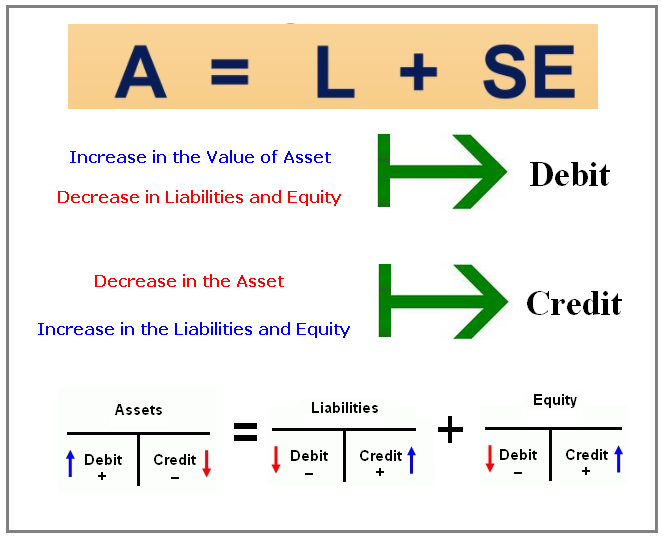

In keeping with the double-entry system of accounting, a minimum of two accounts is needed for every transaction. At least one account is debited and at least one account is credited. if, you have identified the two or more accounts involved in a business transaction, you must debit at least one account and credit at least one account.

To debit an account means to enter an amount on the left side of the account. To credit an account means to enter an amount on the right side of an account.

BASIC NOTE - Debit means left, Credit means right

Generally these types of accounts are increased with a debit:

Dividends (Draws), Expenses, Assets, Losses

Note- D - E - A - L Accounts are increased with a debit.

Generally the following types of accounts are increased with a credit:

Gains, Income, Revenues, Liabilities, Stockholders' (Owner's) Equity

Note - G - I - R - L - S Accounts are increased with a credit.

Note - To decrease an account you do the opposite of what was done to increase the account.

EXAMPLE

An asset account is increased with a debit. Therefore it is decreased with a credit.

The abbreviation for debit is Dr. and the abbreviation for credit is cr.

Some general rules about debiting and crediting the accounts are:

Expense accounts are debited and have debit balances

Revenue accounts are credited and have credit balances

Asset accounts normally have debit balances

To increase an asset account, debit the account

To decrease an asset account, credit the account

Liability accounts normally have credit balances

To increase a liability account, credit the account

To decrease a liability account, debit the account

What do you mean by debit and credit balance of an account?

Debits and credits balance each other . Means, if a debit is added to one account, then a credit must be added to the an opposite account.

In accounting, the debit column is on the left of an accounting entry, while credits are on the right. Debits increase asset or expense accounts and decrease liability or equity.

Why is an expense account debited?

Balances on the right side of an account are credit balances. Since expenses cause a decrease to the owner's equity credit balance, a debit entry is required. However, at the time that the expense is recorded, the amount is entered as a debit in anexpense account.

Can you credit an expense account?

Some instances when general ledger expense accounts are credited include: the end-of-year closing entries. the reversing entry for a previous accrual adjusting entry involving an expense. an adjusting entry to defer part of a prepayment that was debited to an expense account.

Why do revenues have a credit balance?

Liabilities and owner's equity are on the right side of the accounting equation and thebalances in the liability and owner's equity accounts are normally on the right side of the accounts. ...

A credit entry in a revenue account will cause the credit balance in an owner's equity capital account to increase.

Is service revenue a debit or credit?

At the time the service is performed the revenues are considered to have been earned and they are recorded in the revenue account Service Revenues with a credit. The other account involved, however, cannot be the asset Cash since cash was not received. The account to be debited is the asset account Accounts Receivable.

Which types of accounts normally have a credit balance?

Assets, expenses, losses, and the owner's drawing account will normally have debit balances. Their balances will increase with a debit entry, and will decrease with a credit entry. Liabilities, revenues and sales, gains, and owner equity and stockholders' equity accounts normally have credit balances.

Why profit is a credit?

The profit or net income belongs to the owner of a sole proprietorship or to the stockholders of a corporation. The owner's or stockholders' equity is reported on the credit side of the balance sheet. Recall that the balance sheet reflects the accounting equation, Assets = Liabilities + Owner's Equity.

Is an increase in inventory a debit or credit?

Since Assets, Draw, and Expense Accounts normally have a Debit Balance, in order to Increase the Balance of an Asset, Draw, or Expense Account enter the amount in the Debit or Left Side Column and in order to Decrease the Balance enter the amount in the Credit or Right Side Column.

Is Accounts Receivable a debit or credit?

The client is buying on account or paying later, which makes it an Accounts Receivable, which is an asset. When an asset increases, it is a Debit. A sale is considered Revenue or Income, which is shown as REVENUE on the chart. When revenue increases, it is a credit.

What is a revenue item?

Revenue is shown usually as the top item in an income (profit and loss) statement from which all charges, costs, and expenses are subtracted to arrive at net income. Also called sales, or, turnover.

What are the revenues in accounting?

Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery. Often the term income is used instead of revenues.

What does a general ledger of a company Contain?

The ledger provides a complete record of financial transactions over the life of thecompany. The ledger holds account information that is needed to prepare financialstatements and includes accounts for assets, liabilities, owners' equity, revenues and expenses.

What is debit balance of profit and loss account?

Under the 'double entry' accounting convention, income items in the Profit and loss account are Credits (CR) and expenses are Debits (DR). A net profit is a Credit in the Profit and loss account. A net loss is a Debit in the Profit and loss account.

When Cash Is Debited and Credited?

Because cash is involved in many transactions, it will be easy to understand as below:-

- Whenever cash is received, debit Cash,

- whenever cash is paid out, credit Cash.

Normal Debit or Credit Balances ?

See below debit or credit balance you would normally find in the account after Looking at T-account for each of the account classifications in the general ledger .

Account classification & Normal Balance are:-

Assets – Debit Balance , Contra Liability – Debit Balance

Owner’s Drawing or, Divident Accounts - Debit Balance

Expenses – Debit Balance

Losses – Debit Balance

Liability – Credit Balance, Contra Assets – Credit Balance

Owner’s Equity - Credit Balance

Stockholder’s Equity - Credit Balance

Income / Revenue - Credit Balance

Gains - Credit Balance

Revenues and Gains Are Usually Credited ?

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts have debit balances because they are reductions to sales. Accounts with balances that are the opposite of the normal balance are called contra accounts; hence contra revenue accounts will have debit balances.

Whenever cash is received, the asset account Cash is debited and another account will need to be credited. Since the service was performed at the same time as the cash was received, the revenue account Service Revenues is credited, thus increasing its account balance.

Expenses and Losses are Usually Debited ?

Expenses normally have their account balances on the debit side (left side).

A debit increases the balance in an expense account; a credit decreases the balance. Since expenses are usually increasing, think "debit" when expenses are incurred.

We credit expenses only to reduce them, adjust them, or to close the expense accounts.

Examples of expense accounts include Salaries Expense, Wages Expense, Rent Expense, Supplies Expense, and Interest Expense.

Bank's Debits and Credits ?

Bank credit means the transaction will increase your checking account balance.

If, your bank debits your account means your checking account balance decreases.

Although the above rule may seem contradictory & confusing because you have read that , debiting the Cash account in the general ledger increases its balance and crediting the Cash account in the general ledger reduces its balance.

But bank says it is debiting your account to reduce its balance and crediting your account to increase its balance.

But interestingly, bank's treatment of debits and credits is indeed consistent with the basic accounting principles. You have to see some example & background journal entry to understand further.

End of Page

Please select any one of the below options to give a LIKE, how do you know this unit.